Cybersecurity compliance for financial institutions

News & Insights

10 Min Read

Cybersecurity Compliance for Financial Institutions: Ensuring Protection in a Digital World In the financial sector, cybersecurity is more than just a technical necessity; it’s a regulatory and operational imperative. Financial institutions handle vast amounts of sensitive data, including personal and financial information, making them prime targets for cybercriminals. This heightened risk has led to stricter cybersecurity compliance regulations designed to protect both the organization and its customers. In this post, we’ll explore the importance of cybersecurity compliance for financial institutions, key regulations that govern the industry, and best practices for maintaining compliance while mitigating cybersecurity risks.

Why Cybersecurity Compliance is Critical for Financial Institutions

Financial institutions, such as banks, credit unions, and insurance companies, are among the most targeted sectors for cyberattacks. These organizations are responsible for safeguarding vast amounts of personal data, financial records, and payment transactions, making them attractive targets for criminals seeking to steal sensitive information or execute fraudulent activities.

Compliance with cybersecurity regulations helps institutions:

Protect Customer Data: Ensuring that personal and financial data is kept secure from breaches and unauthorized access.

Meet Legal and Regulatory Requirements: Financial institutions must adhere to various industry standards and regulations to avoid penalties and reputational damage.

Enhance Trust with Customers: By demonstrating a commitment to cybersecurity, financial institutions build trust and loyalty among their customers.

Reduce Cybersecurity Risks: By following best practices, institutions can identify vulnerabilities, prevent attacks, and minimize the impact of potential breaches.

Key Cybersecurity Regulations for Financial Institutions

Financial institutions are subject to a wide range of cybersecurity regulations aimed at protecting customer data and ensuring the integrity of financial systems. Here are some of the most important regulations:

1. Gramm-Leach-Bliley Act (GLBA)

The GLBA mandates that financial institutions establish safeguards to protect sensitive customer information. It includes provisions such as:

Safeguards Rule: Requires financial institutions to implement measures to secure customer information, including encryption and access control.

Privacy Rule: Ensures that customers’ non-public personal information is not shared without their consent, except under specific conditions.

Pretexting Rule: Prevents the use of false pretenses to access customer information.

2. Payment Card Industry Data Security Standard (PCI DSS)

For institutions involved in processing credit card payments, the PCI DSS is critical for securing payment data. Key requirements include:

Encryption: Ensuring that credit card data is encrypted both at rest and in transit.

Access Control: Limiting access to sensitive cardholder information to authorized personnel only.

Regular Audits: Conducting regular vulnerability scans and penetration testing to identify weaknesses.

3. Federal Financial Institutions Examination Council (FFIEC)

The FFIEC provides guidelines for financial institutions on managing cybersecurity risks. It offers a framework to ensure that institutions implement robust security measures, conduct thorough risk assessments, and prepare for potential cyber threats. Key recommendations include:

Cybersecurity Risk Assessment: Regular assessments to identify, prioritize, and mitigate potential risks.

Incident Response Plan: Developing a plan to respond quickly and efficiently to security breaches or cyberattacks.

4. Sarbanes-Oxley Act (SOX)

While SOX is primarily focused on financial reporting, it also has significant implications for cybersecurity. Financial institutions must ensure that their financial records are protected from cyber threats, and that any data breaches are promptly reported to regulators and shareholders.

5. Dodd-Frank Wall Street Reform and Consumer Protection Act

This act established the Consumer Financial Protection Bureau (CFPB) and introduced measures to reduce systemic risk in the financial sector. It also includes provisions for protecting customer data and enhancing the transparency of financial institutions.

6. General Data Protection Regulation (GDPR)

For financial institutions that handle the personal data of EU citizens, GDPR compliance is mandatory. GDPR mandates stringent controls on the collection, processing, and storage of personal data, including requirements for encryption, data minimization, and customer consent.

7. State-Specific Regulations

In addition to federal and global regulations, financial institutions must also comply with state-level regulations. For example:

New York’s Cybersecurity Regulation (23 NYCRR 500): Requires financial services companies to establish a cybersecurity program, including the implementation of controls and reporting to the New York Department of Financial Services (NYDFS).

California Consumer Privacy Act (CCPA): Requires businesses, including financial institutions, to protect personal information and provide consumers with rights over their data.

Best Practices for Achieving and Maintaining Cybersecurity Compliance

Achieving cybersecurity compliance is a continuous process that involves ongoing monitoring, testing, and adjustments. Below are some best practices for financial institutions to follow:

1. Implement Strong Access Controls

Access to sensitive financial data should be limited to authorized personnel only. Use Role-Based Access Control (RBAC) to ensure that individuals only have access to the data they need to perform their job functions. Multi-factor authentication (MFA) should be enforced for all access points.

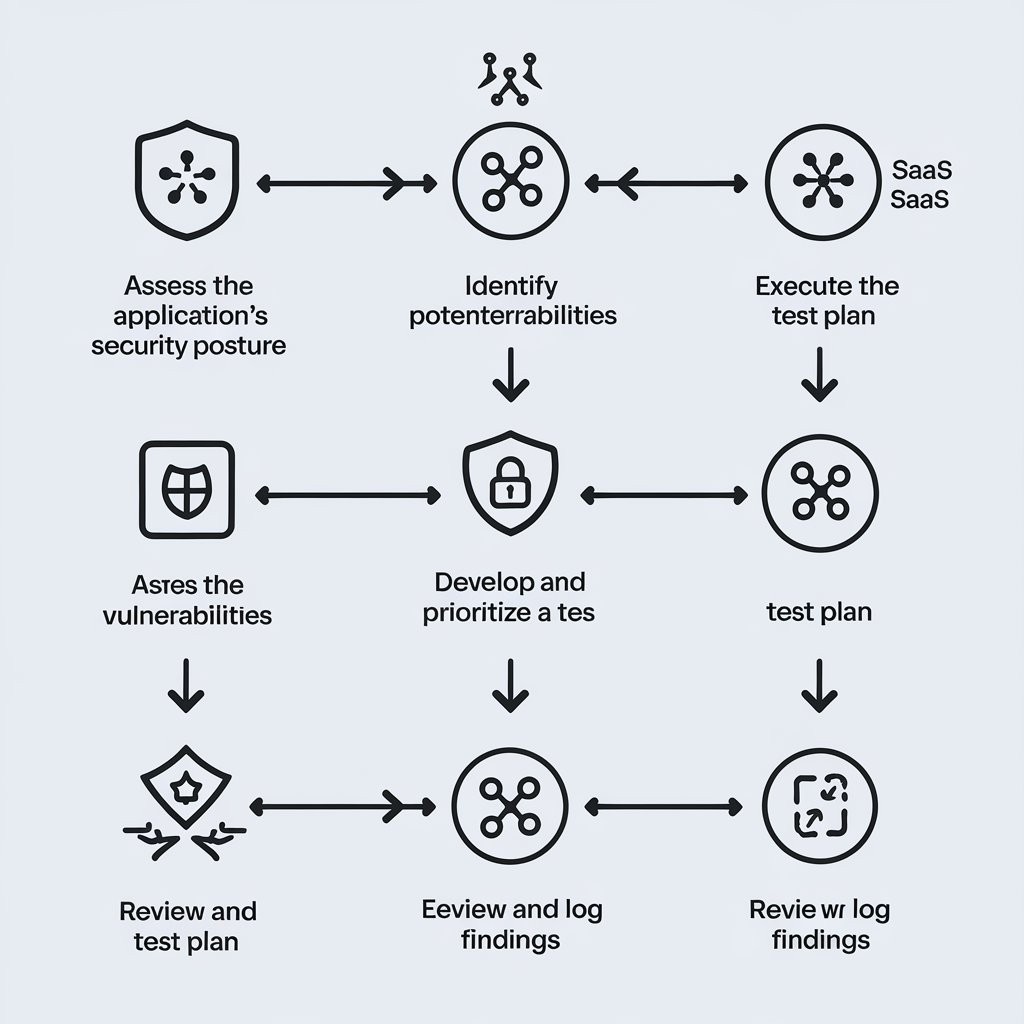

2. Conduct Regular Security Audits and Vulnerability Assessments

To stay compliant and secure, regular security audits are essential. These audits help financial institutions identify vulnerabilities and gaps in their cybersecurity infrastructure, allowing them to take corrective actions before an attack occurs.

3. Develop an Incident Response Plan

A well-structured incident response plan is crucial for handling potential data breaches or cybersecurity attacks. Financial institutions should be prepared to respond quickly to mitigate damage, communicate with stakeholders, and comply with breach notification laws.

4. Encrypt Sensitive Data

Encryption is a key component of cybersecurity compliance. Financial institutions must encrypt sensitive customer data both at rest and in transit. This ensures that even if data is intercepted, it cannot be read or used by unauthorized individuals.

5. Train Employees on Cybersecurity Best Practices

Employees are often the weakest link in cybersecurity, so providing regular cybersecurity training is essential. Educate staff about common threats like phishing, social engineering, and malware, and train them on best practices for securing data and systems.

6. Stay Up to Date with Regulations

Cybersecurity regulations are constantly evolving. Financial institutions must stay up to date with changes to existing laws and the introduction of new regulations to ensure they remain compliant. Regularly consult legal experts and regulatory bodies for updates on compliance requirements. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.