Protecting financial data in the cloud

News & Insights

5 Min Read

Protecting Financial Data in the Cloud With more businesses migrating to the cloud, protecting financial data stored in cloud environments has become a top priority. Financial data is highly sensitive and valuable, making it a prime target for cybercriminals. Whether it’s personal financial information, payment details, or proprietary financial data, organizations must implement robust measures to ensure the confidentiality, integrity, and availability of financial data stored in the cloud. Here are best practices for protecting financial data in the cloud:

1. Use Strong Encryption Methods

Encryption is one of the most effective ways to protect financial data in the cloud. By encrypting data both at rest (when stored on cloud servers) and in transit (when being transferred between systems), you ensure that even if unauthorized individuals gain access to your data, they won’t be able to read or misuse it.

Encryption at Rest: Ensure that your cloud service provider supports strong encryption for data stored in the cloud. Use encryption tools to safeguard sensitive financial records, such as bank account information, transaction logs, and investment data.

Encryption in Transit: Use secure protocols like TLS (Transport Layer Security) or SSL (Secure Sockets Layer) to protect data when transmitted between servers, clients, and other systems.

2. Implement Multi-Factor Authentication (MFA)

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to verify their identity using two or more forms of authentication. This significantly reduces the likelihood of unauthorized access to cloud systems storing financial data.

Two-Factor Authentication (2FA): Combine something the user knows (password) with something the user has (such as a phone for a one-time password).

Biometric Authentication: For highly sensitive data, you can require biometric factors such as fingerprint or facial recognition.

By enforcing MFA, even if a password is compromised, attackers would still need another form of verification to gain access to the cloud system.

3. Data Backup and Disaster Recovery

To ensure that financial data is not lost due to unforeseen circumstances such as a cyberattack, hardware failure, or natural disaster, regular backups and a well-defined disaster recovery plan are essential.

Regular Backups: Automate frequent backups of your financial data to multiple cloud locations. This will allow your organization to restore the data in the event of corruption, deletion, or loss.

Disaster Recovery Plan: Develop and test a comprehensive disaster recovery plan to restore your financial data in case of a data breach or major disruption. Cloud services often offer tools for quick recovery, but it’s crucial to have processes in place.

4. Implement Data Access Controls

Restrict access to financial data based on roles within the organization. The principle of least privilege ensures that employees and third-party vendors only have access to the data necessary to perform their job functions. This reduces the risk of exposure from internal threats.

Role-Based Access Control (RBAC): Assign different levels of access to employees depending on their role and responsibilities. Senior staff might have access to all financial data, while junior staff may have access only to certain accounts or records.

Audit Logs: Continuously monitor access to financial data with detailed logging. This allows you to track any unauthorized attempts or unusual access patterns, helping detect potential threats early.

5. Choose a Trusted Cloud Service Provider

Selecting a cloud service provider (CSP) with a strong security track record is vital for protecting financial data. Ensure your CSP complies with industry regulations and implements rigorous security measures to safeguard your data.

Certifications and Compliance: Verify that the CSP meets compliance standards such as PCI DSS (Payment Card Industry Data Security Standard), ISO 27001, and SOC 2 to ensure they follow industry best practices for cloud security.

Data Center Security: Make sure that the CSP’s data centers have strong physical security measures in place, including surveillance, restricted access, and disaster recovery systems.

6. Secure APIs and Integrations

Many financial systems rely on APIs to interact with other services, both within and outside the cloud environment. Ensuring that APIs are secure is crucial for protecting sensitive financial data.

API Security: Use OAuth, API keys, and other authentication protocols to secure data exchanges between systems. Avoid transmitting sensitive financial data via unsecured APIs.

Regular Testing: Conduct penetration testing on APIs to identify vulnerabilities and patch them before they can be exploited by attackers.

7. Monitor and Detect Security Threats

Ongoing monitoring and threat detection are critical for identifying suspicious activity and minimizing the impact of a potential breach.

Security Information and Event Management (SIEM): Implement SIEM systems to collect, analyze, and correlate security logs across your cloud infrastructure. This helps identify potential threats and respond to them in real time.

Intrusion Detection Systems (IDS): Deploy intrusion detection systems that can detect abnormal activity and alert administrators immediately.

8. Encrypt Data Sharing and Communication

Financial data often needs to be shared with third parties, including banks, payment processors, or auditors. It’s important to use secure methods of sharing and communication.

Secure File Sharing: Use secure, encrypted file-sharing solutions to exchange sensitive data with authorized parties.

Email Encryption: Encrypt financial data in emails, particularly when sending payment details or contracts. Ensure that email servers support secure encryption standards like S/MIME or PGP.

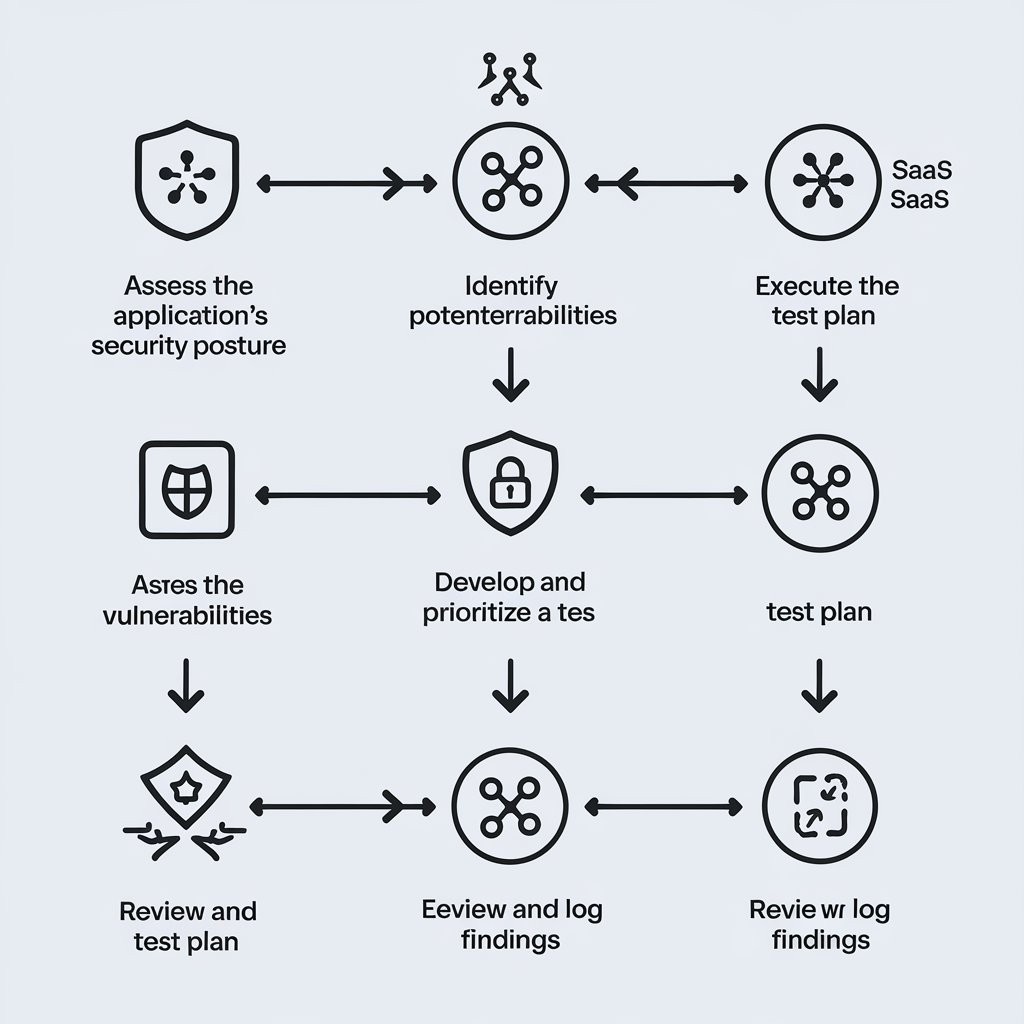

9. Regular Security Audits

Conduct regular security audits to evaluate your cloud security measures and ensure compliance with relevant regulations. Audits will help identify vulnerabilities, gaps in your security posture, and areas where additional measures may be needed.

Vulnerability Scanning: Regularly scan cloud-based financial applications for vulnerabilities that could expose sensitive data to hackers.

Compliance Audits: Ensure that your cloud financial data storage complies with industry standards and regulations to avoid penalties.

10. Employee Training and Awareness

Employees must be trained to recognize cybersecurity threats and follow best practices for data protection. This includes understanding the risks of phishing, social engineering, and other attack methods that can compromise financial data security.

Phishing Awareness: Train employees on how to identify phishing attempts and avoid clicking on suspicious links that could lead to data breaches.

Cybersecurity Best Practices: Educate employees about cloud security practices, password hygiene, and the importance of maintaining secure connections to the cloud. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.