The role of cybersecurity risk management in compliance

News & Insights

5 Min Read

The Role of Cybersecurity Risk Management in Compliance In today's digital landscape, cybersecurity risk management is a critical component of a comprehensive compliance strategy. With the increasing frequency and sophistication of cyber threats, regulatory authorities across various industries have introduced strict compliance frameworks to ensure organizations protect sensitive data and maintain operational integrity. Cybersecurity risk management plays a central role in meeting these compliance requirements while also minimizing business risks.

1. Understanding Cybersecurity Risk Management

Cybersecurity risk management refers to the process of identifying, assessing, and mitigating the risks posed by cybersecurity threats. This involves:

Risk Identification: Recognizing potential threats to the organization's assets, including data breaches, cyber-attacks, or system vulnerabilities.

Risk Assessment: Evaluating the likelihood and potential impact of these threats on business operations, data security, and compliance status.

Risk Mitigation: Implementing controls and strategies to reduce or eliminate these risks, such as security protocols, encryption, and monitoring tools.

Risk management ensures that businesses are proactive in addressing vulnerabilities, rather than reactive when breaches occur.

2. Aligning Cybersecurity with Compliance Standards

Cybersecurity risk management is integral to ensuring an organization meets industry-specific compliance regulations, which are often designed to protect sensitive data and minimize cyber threats. Several widely recognized regulatory standards and frameworks rely heavily on risk management practices:

General Data Protection Regulation (GDPR): A stringent data protection law within the European Union that mandates businesses to protect personal data. It requires organizations to assess the risks to the privacy of individuals and implement necessary controls.

Health Insurance Portability and Accountability Act (HIPAA): A U.S. regulation that focuses on safeguarding healthcare data. Risk management processes are crucial in identifying vulnerabilities in health systems and mitigating them to prevent breaches.

Payment Card Industry Data Security Standard (PCI DSS): A set of security standards for businesses that handle credit card transactions. Organizations must assess risks related to payment systems and ensure compliance through robust cybersecurity measures.

Federal Information Security Management Act (FISMA): A U.S. law that mandates federal agencies and contractors to secure information systems. Risk management is required to assess, prioritize, and address cybersecurity risks in these systems.

3. Proactive Identification of Risks

One of the key roles of cybersecurity risk management in compliance is to proactively identify potential risks before they lead to non-compliance or data breaches. This includes:

Vulnerability Scanning: Regularly scanning systems and applications for vulnerabilities that could lead to security incidents.

Threat Intelligence: Leveraging external and internal threat intelligence sources to identify emerging risks and trends that could affect compliance.

Continuous Monitoring: Implementing real-time monitoring to track and respond to any changes in risk posture, ensuring compliance with evolving regulations.

By staying ahead of potential risks, organizations can maintain compliance and avoid costly fines, penalties, or reputational damage.

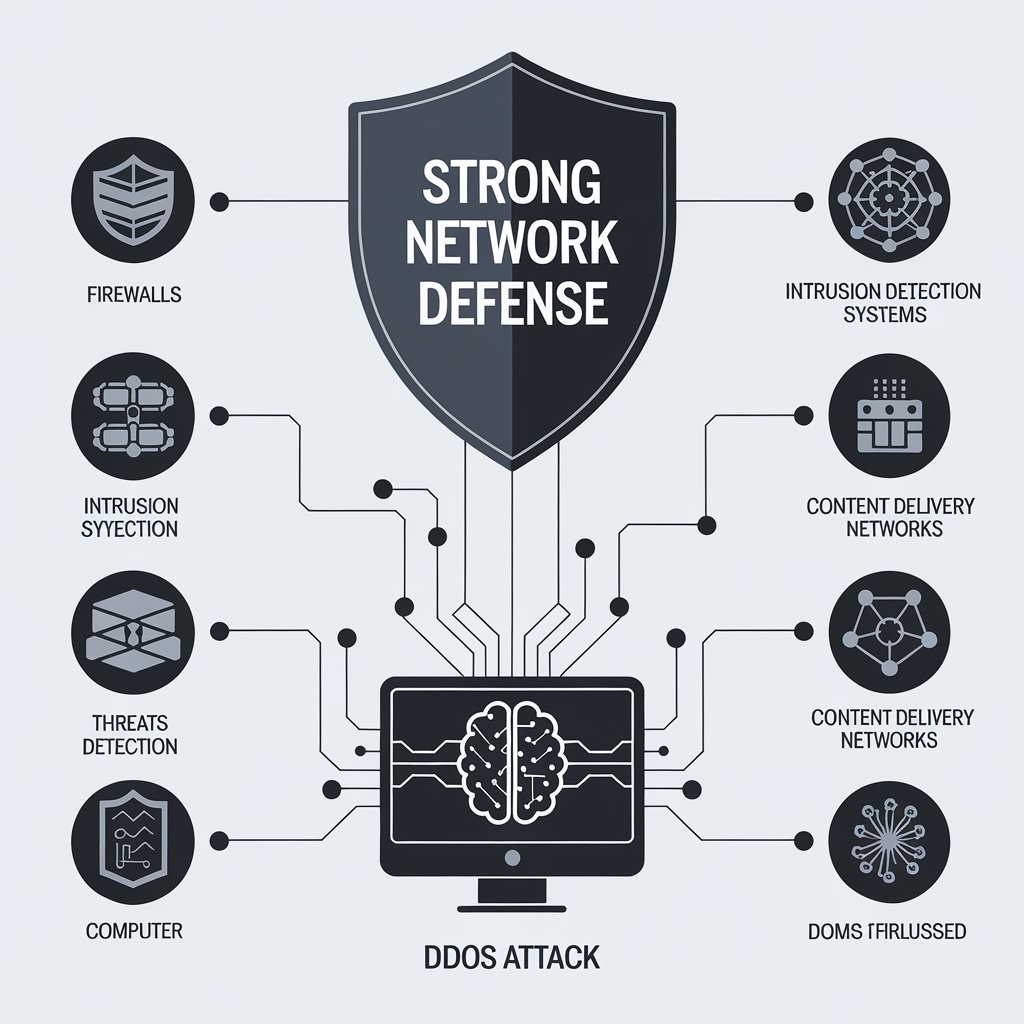

4. Implementing Security Controls for Risk Mitigation

Risk management involves implementing security controls and countermeasures that align with compliance requirements. These controls are designed to reduce or eliminate the likelihood of security incidents and ensure the protection of sensitive data. Key measures include:

Access Control: Limiting access to sensitive data and systems based on the principle of least privilege, ensuring only authorized personnel can view or manipulate data.

Encryption: Encrypting data both at rest and in transit to protect sensitive information from unauthorized access.

Incident Response Plans: Developing and testing cybersecurity incident response plans to quickly address and mitigate the impact of security breaches.

Multi-Factor Authentication (MFA): Requiring multiple forms of verification to access systems and data, reducing the likelihood of unauthorized access.

These security controls help businesses not only mitigate risks but also fulfill specific compliance obligations outlined in regulatory frameworks.

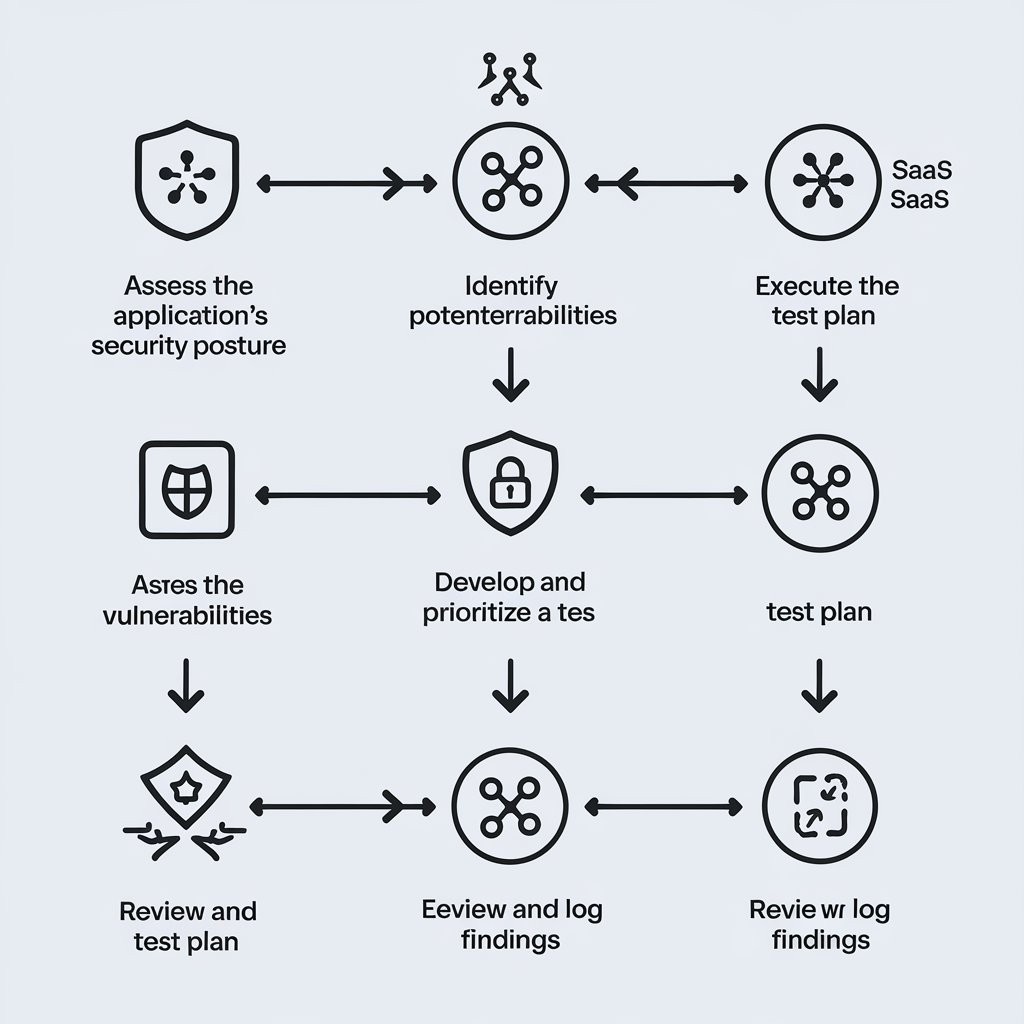

5. Regular Audits and Assessments

Compliance regulations often require businesses to undergo periodic cybersecurity audits and assessments. Cybersecurity risk management ensures that organizations are ready for these evaluations by:

Conducting Risk Assessments: Regularly reviewing risk management strategies and identifying new or emerging threats.

Documenting Compliance: Maintaining records of risk assessments, security controls, and mitigation strategies to demonstrate compliance during audits.

Continuous Improvement: Regularly updating and refining security practices to adapt to new regulations or evolving cyber threats.

Audits and assessments verify that an organization’s cybersecurity posture aligns with industry standards and legal requirements, reducing the risk of non-compliance.

6. Protecting Sensitive Data and Privacy

At the heart of most cybersecurity regulations is the need to protect sensitive data, such as personal identifiable information (PII), financial data, and healthcare records. Cybersecurity risk management is critical in ensuring that sensitive data is:

Secured: Using encryption, firewalls, and secure access protocols to protect data from unauthorized access or breach.

Monitored: Implementing real-time monitoring and detection to spot any unusual activity that might indicate a breach of sensitive information.

Managed: Implementing data retention and deletion policies to ensure that sensitive data is only kept as long as necessary and is securely destroyed when no longer needed.

By securing sensitive data, businesses not only reduce their exposure to risks but also ensure compliance with regulations that govern data protection.

7. Avoiding Financial Penalties

Non-compliance with cybersecurity regulations can result in significant financial penalties. By adopting strong cybersecurity risk management practices, businesses can avoid costly fines. For example:

GDPR: Non-compliance can result in fines up to 4% of annual global turnover or €20 million (whichever is greater).

PCI DSS: Non-compliance can result in fines, increased transaction fees, and potential loss of the ability to process payments.

Through diligent risk management, organizations can avoid these penalties and the financial repercussions of failing to meet compliance requirements.

8. Building a Security-First Culture

Cybersecurity risk management instills a security-first mindset throughout the organization, ensuring that employees, partners, and vendors understand the importance of data protection. This includes:

Training and Awareness: Educating employees about cybersecurity risks, phishing scams, and the importance of protecting sensitive data.

Vendor Risk Management: Ensuring third-party vendors and partners also adhere to the same cybersecurity standards to avoid supply chain vulnerabilities.

Ongoing Education: Offering continuous training programs to keep staff updated on best practices for cybersecurity and compliance.

A strong security culture supports overall compliance efforts and helps mitigate internal risks. audit3aa

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.